Case study

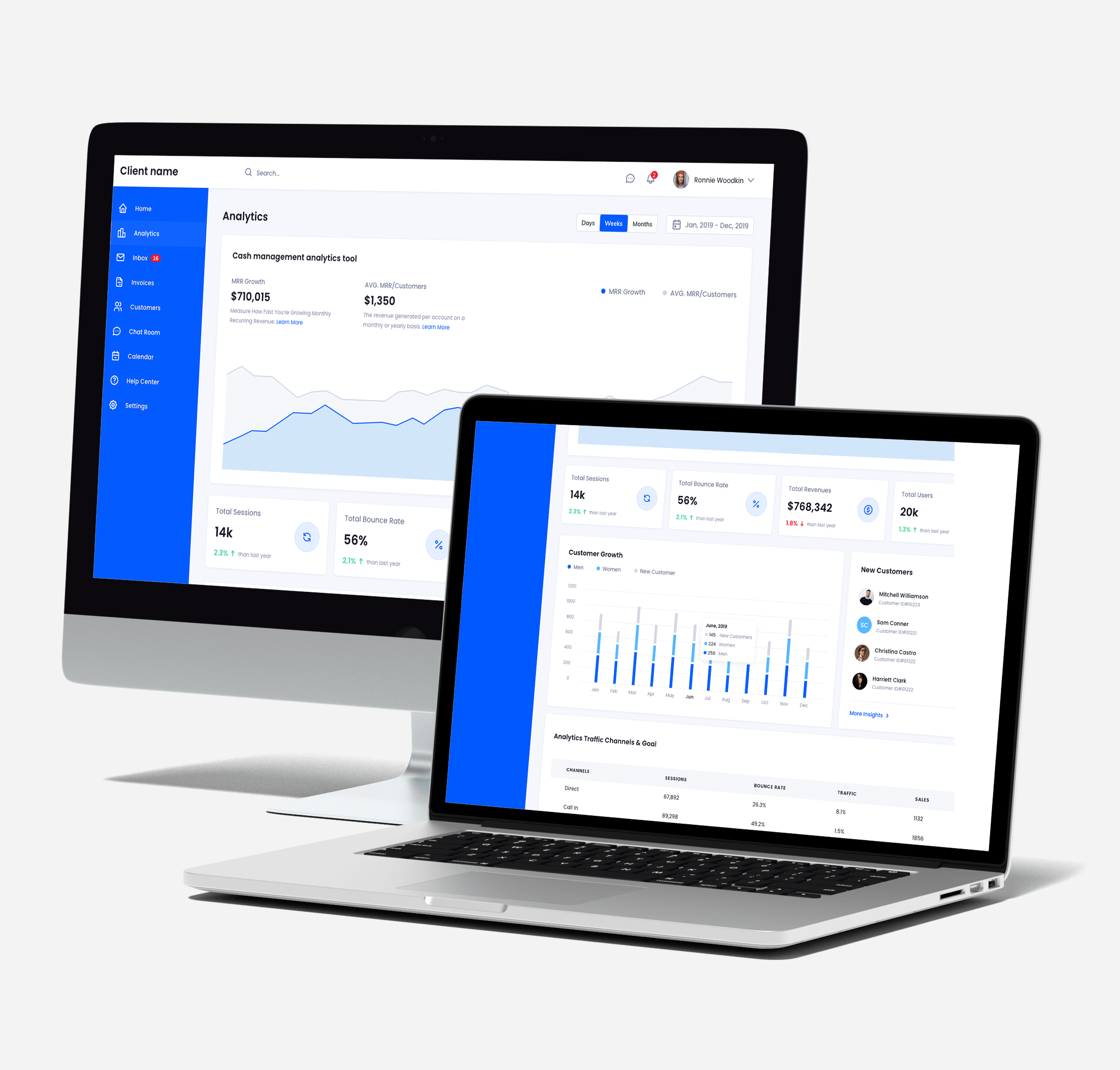

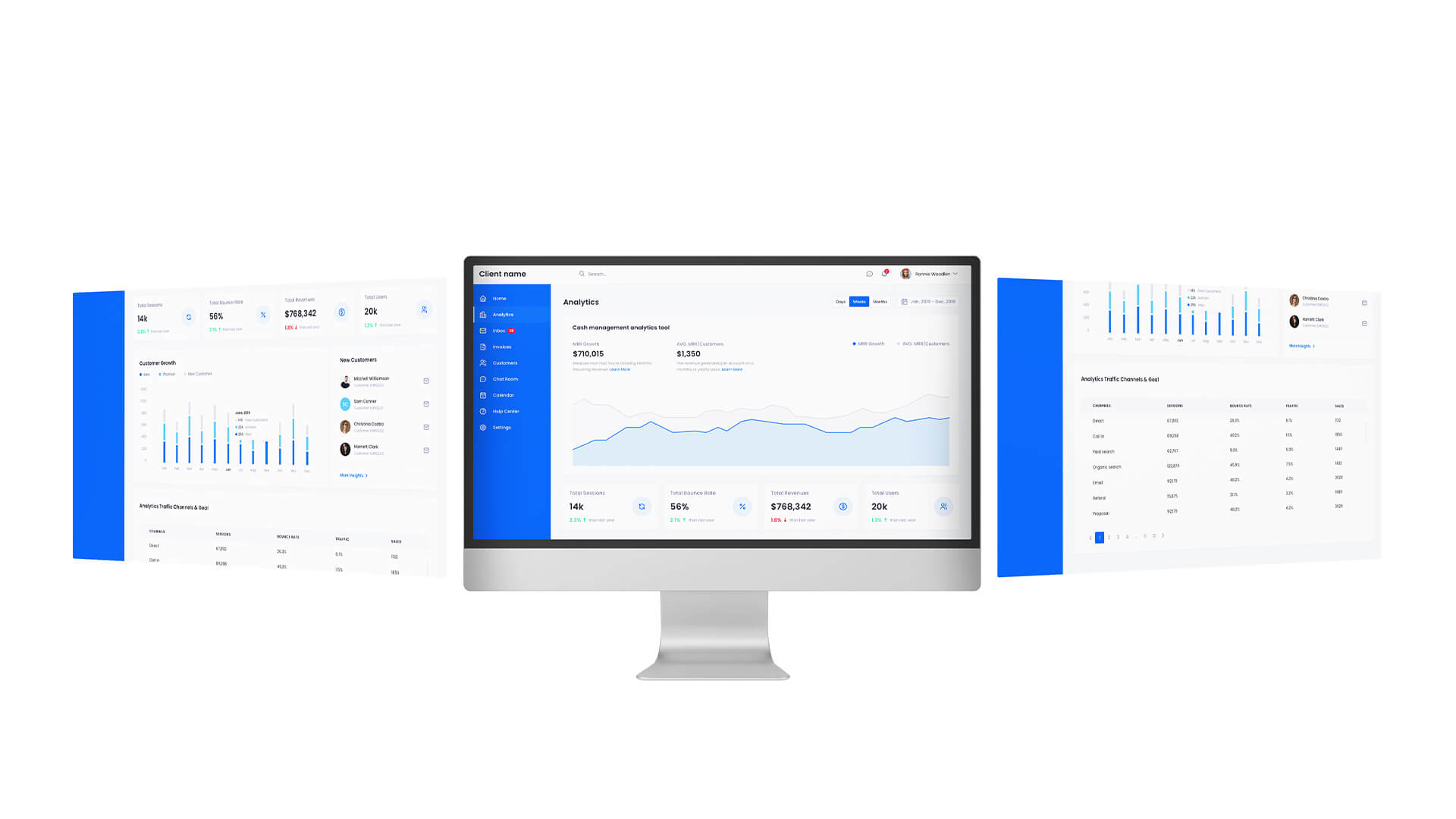

Cash Management Analytics Tool

Highlights

- Complex e-Banking web application for real-time visibility of banking estates.

- The team at Fortech developed the UI application and rewrote legacy code.

- A continuous improvement practice was adopted.

Technologies:

.NET Core 2.0, C#, Angular 4, PostgreSQL, Docker, GIT

Services:Project Management, Software Development, Software Testing

6

Team Size2 Years

DurationFinancial

Industry

Client Benefits

Speed

Fast prototyping, and development followed by frequent releases into production.

Ramp-Up

The ability to fast ramp-up the team as the project evolved.

Skills

Mixed seniority team with strong technical know-how.