Build Customer Loyalty in Banking with Speech Recognition Software Development

23 January 202409 April 2021 | Software

Speech recognition is no longer something out of sci-fi movies. Even as early as 2017, Google had achieved a 95% accuracy rate for US English. Now, speech recognition technology on smart devices, ranging from phones to appliances and smart speakers, can understand a host of different languages and accents. Devices with voice assistants are expected to surge from an estimated 4.2 billion in 2020 to around 8 billion by 2023. The deep penetration of voice assistants can be truly appreciated by comparing this with the world population, which was an estimated 7.8 billion in March 2021.

Cutting-edge speech recognition is hugely popular as it allows users to ask questions, search for information, and give commands for tasks in a completely hands-free mode. Compared to chatbots, voice is faster, more convenient and allows multitasking. Over time, the conversational capabilities have become more “human”.

Talking to a device is fast becoming a part of our daily routine. The banking sector has woken up to this new normal, which presents great potential to enhance customer experience and helps attract a new generation of tech-savvy consumers. Chatbots became smarter and more personalized. Brands using this technology already have some data at their disposal to launch intelligent voice technology.

Integrating speech recognition in banking adds a new layer of sophistication to customer services, making interactions faster, easier and more secure. Banks can either leverage this new trend or risk getting left behind.

Table of Contents

- Integration with Virtual Assistants

- Speech Recognition: Use Cases for the Banking Industry

- Fostering Deep Relationships with Customers

- Challenges in Enabling Speech Recognition

Integration with Virtual Assistants

Voice banking was the natural next step for millions of tech-savvy users who have adopted voice assistants (VAs) like Alexa, Google Assistant, and Siri as part of their daily life.

Source: weforum.org

Over the past few years, several banks have introduced customer service interfaces equipped with voice capabilities simply by integrating VAs. Since speech recognition is already highly evolved, integration allows banks to deploy VAs without the overhead of developing the technology from scratch.

Source: reviews.com

The software solution does, however, need to be flexible enough to serve different customer needs. For instance, if a customer is filling out a loan application form via voice, they might want the VA to provide alerts when the application gets accepted.

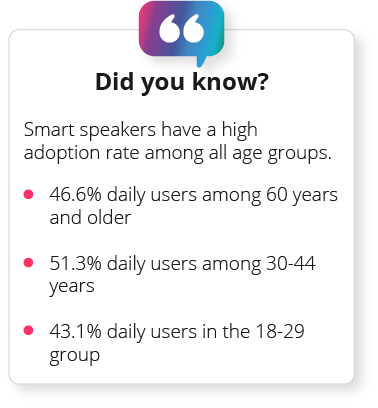

This advanced level of convenience will enable banks to attract new customers and convert them into loyal ones. The largest target market for banks – those between 30 to 44 years – has the highest percentage of daily users of smart speakers, at 51.3%.

As a leading financial services software development company, Fortech deploys innovative technologies as end-to-end custom solutions. We help financial institutions make the transition from a traditional to a completely digital ecosystem, enabling them to thrive in the fast-evolving banking landscape.

Speech Recognition: Use Cases for the Banking Industry

Speech recognition holds immense potential for the banking industry to grow revenues, minimize risks, lower overhead costs, and gain a competitive edge. Here is how this cutting-edge technology has become the new frontier in enabling banks to drive customer engagement.

Adding an Extra Layer of Security

HSBC and Barclays are already investing in this space, using voice for biometric authentication. Between 2016 and 2020, HSBC UK was able to identify over 29,000 fraudulent calls and saved an estimated £395 million worth of customer money through VoiceID technology.

Using voice as a unique identifier, banks can add another layer of security. Think of this as 3-step authentication for heightened security.

Some banks are using voice alone to identify customers. The advantages include:

- Customers do not need to remember complicated passwords.

- Customers may lose their phone (on which they receive the one-time password (OTP) for authentication). This problem does not exist with voice.

- Fraud is practically eliminated.

What if a customer’s voice changes over time? Such hurdles have gradually been overcome. There are solutions that record and store more than 100 unique voice characteristics, and even consider the natural aging in voice.

Voice-Based Account Servicing and Transactions

Voice devices enable swift customer onboarding. They can guide new customers through all the stages of account opening, KYC, explaining offerings and resolving queries.

Banking customers have been using voice commands to check their account balance, transaction history, reward points and more for some time now. In 2017, the Royal Bank of Canada, Santander and Barclays integrated Siri into bill payments, while Turkey’s Garanti Bank introduced voice-based services for customers to check currency rates and make forex transactions.

In 2018, The Westpac Banking Corporation in Australia launched the ‘Westpac Alexa Skill’, which provides the option to receive exclusive market updates on Alexa. By taking this approach, these banks not only offered personalized services to customers but did so with an exclusive branding touch. Finance and baking behemoth Morgan Stanley launched a voice application enabling users to access market insights, while JPMorgan introduced voice services to provide real-time information to professional investors.

In 2018, The Westpac Banking Corporation in Australia launched the ‘Westpac Alexa Skill’, which provides the option to receive exclusive market updates on Alexa. By taking this approach, these banks not only offered personalized services to customers but did so with an exclusive branding touch. Finance and baking behemoth Morgan Stanley launched a voice application enabling users to access market insights, while JPMorgan introduced voice services to provide real-time information to professional investors.

With advancements in contextual understanding and customized voice detection, new use cases continue to evolve. For instance, as more customers use smartphones for banking services, connected car payments could become the new normal. As per the Digital Drive Report 2019, 135 million US citizens commute to work 5 days a week and spend on average 51 minutes inside their cars.

Over 73% of them remain connected to the internet. This represents a new touchpoint for banks. Integration of banking apps with connected cars could allow drivers to pay for gas and car repairs without reaching for their wallets. Voice technology could enable banks to explore many more new frontiers.

Conversational Banking Services

Financial institutions recognize that rich customer experiences rely heavily on the quality and timing of the products and services recommendations. AI-based voice assistants can understand customer needs in deeper and more complex ways.

For instance, voice-based Conversational User Interfaces (CUI) can play the role of financial advisers or customer service representatives. The technology can use real-time data analysis and previous interactions to provide contextual conversations.

“Why should people learn to use technology interfaces when we can simply make the technology more human? A human-first approach would be built around natural conversation: we would do away with the keyboards and touchscreens that currently intermediate our interactions, and instead simply talk to digital technology as we would to a human,” says Fernando Lucini.

The potential to humanize digital banking already exists, allowing banks to achieve a new level of personalization to build deeper and broader customer engagement.

During the pandemic-led lockdowns in 2020, NatWest faced a nearly 30X surge in customer call volumes. To meet this challenge, the leading UK bank launched their voice assistant, Cora. Voice conversations became the cornerstone of NatWest’s digital transformation and the bank is now committed to making this technology its leading point of contact for all customers across all channels by 2025.

“Customers want to bank at the time of their choice, anywhere, with instant communication and instant assurance for their finances,” says Ankit Chhajer, Artificial Intelligence Lead, NatWest.

Managing Cost Efficiency

A huge benefit of speech recognition for the banking sector is that it goes beyond the initial customer engagement stage. These systems can save time in the ID verification process and address frequently asked questions related to banking transactions and product recommendations. Such services would otherwise have to be fulfilled by customer service executives. Given their large customer base, banks can drive significant operational efficiencies and reduce customer churn by using speech recognition software.

Voice bots can reduce customer wait time by 92% and increase first call resolution by 80%. Voice assistants promote self-service, which not only offers customers the flexibility to use the services at their convenience but also spells huge cost savings for banks.

Banks are increasingly using automation and AI-based technologies. The usability and value creation by these technologies can be significantly enhanced with the integration of voice. Take the case of robo-advisors, which are automated platforms providing algorithm-driven advice on a variety of financial and investment matters. A robo-advisor integrated with speech recognition can provide even more user-friendly support for customers.

Fostering Deep Relationships with Customers

Building customer loyalty is one of the biggest challenges for banks. As consumer behavior evolves, so do loyalty patterns.

The race to include new technologies to remain competitive is fierce. Speech recognition can make interactions more personal and proactive. Highly personalized services and targeted and helpful financial advice can become true differentiators, helping banks foster deeper relationships with customers.

Speech recognition ushers in a new era of customer service, improving the customer experience and building loyalty. In other words, speech recognition technology has the power to enable banks to seamlessly integrate their services into the daily lives of customers.

Some banks are using speech recognition technology to simply understand queries and route the customer to the appropriate department for resolution. Other banks are actively exploring voice analytics to understand and address customer complaints in real-time. This will significantly reduce resolution time and costs while ensuring a seamless user experience and providing data for future decision-making.

Speech recognition technology will allow banks to extend customer relationships beyond a single device or branch location. It enables banks to provide 24/7 access to their services from any location in any time zone. Increased interactions with consumers will provide critical insights into demographics, purchasing behavior, income levels and more. Banks can use this to personalize services and build customer loyalty.

Challenges in Implementing Speech Recognition

While speech recognition offers a plethora of advantages, there are some hurdles to overcome. Introducing speech recognition for voice-based authentication, banking services and transactions requires some streamlining of processes. The new technology has huge potential if it is seamlessly integrated into the other banking processes. Even the simplest function of a customer querying their account balance requires account details to be mapped to the voice search.

Banks can also use customer data to enhance their products. This, too, requires smooth transfer of information. For example, banks using speech recognition to provide customer support will need a process to integrate information captured during the conversation. Ideally, the customer details are already present in the database.

Banks will need to consider what happens if the customer’s query cannot be addressed. When a human agent needs to step in, they should not have to ask the same questions that the customer has already answered to the voice assistant.

Banks also need to recognize and manage customer perceptions. For instance, millennials may prefer voice-based services, while Gen X may prefer to interact with a human. Through strategic and continuous communication, banks can make customers feel more comfortable with voice-based services.

Fortech partners closely with clients to ensure seamless integration of speech recognition technology with other processes.

Conclusion

Beyond any doubt, voice offers more compelling advantages over chatbots. To interact with chatbots customers are forced to stare at a screen and use a keyboard or touchscreen to type in their query. With speech recognition, customers can interact with banks even while driving or completing a domestic chore. Voice has not only made interactions faster and more convenient but also promotes accessibility and financial inclusion.

The integration of speech recognition in banking services ushers in a new era of personalized finance. It also requires organizational commitment, upgrades in back-office processes and serious engineering talent.

Fortech offers industry-leading financial software development services to help banks navigate an ever-changing, highly competitive landscape. We have extensive experience in both mainstream and niche technologies. Contact us for innovative and reliable financial software solutions.

About the Author

Andrei

After completing his Bachelor’s Degree in Computer Science and working for 4 years as an analyst programmer, Andrei joined Fortech in April 2006. Given his passion for technology and deep understanding of client requirements and expectations, he made rapid progress to become Project Lead by 2013 and was recently promoted as Growth Manager. He believes software solutions should be elegant and efficient.In his spare time, Andrei tinkers with old cars, electronics, and some woodworking.