Case study

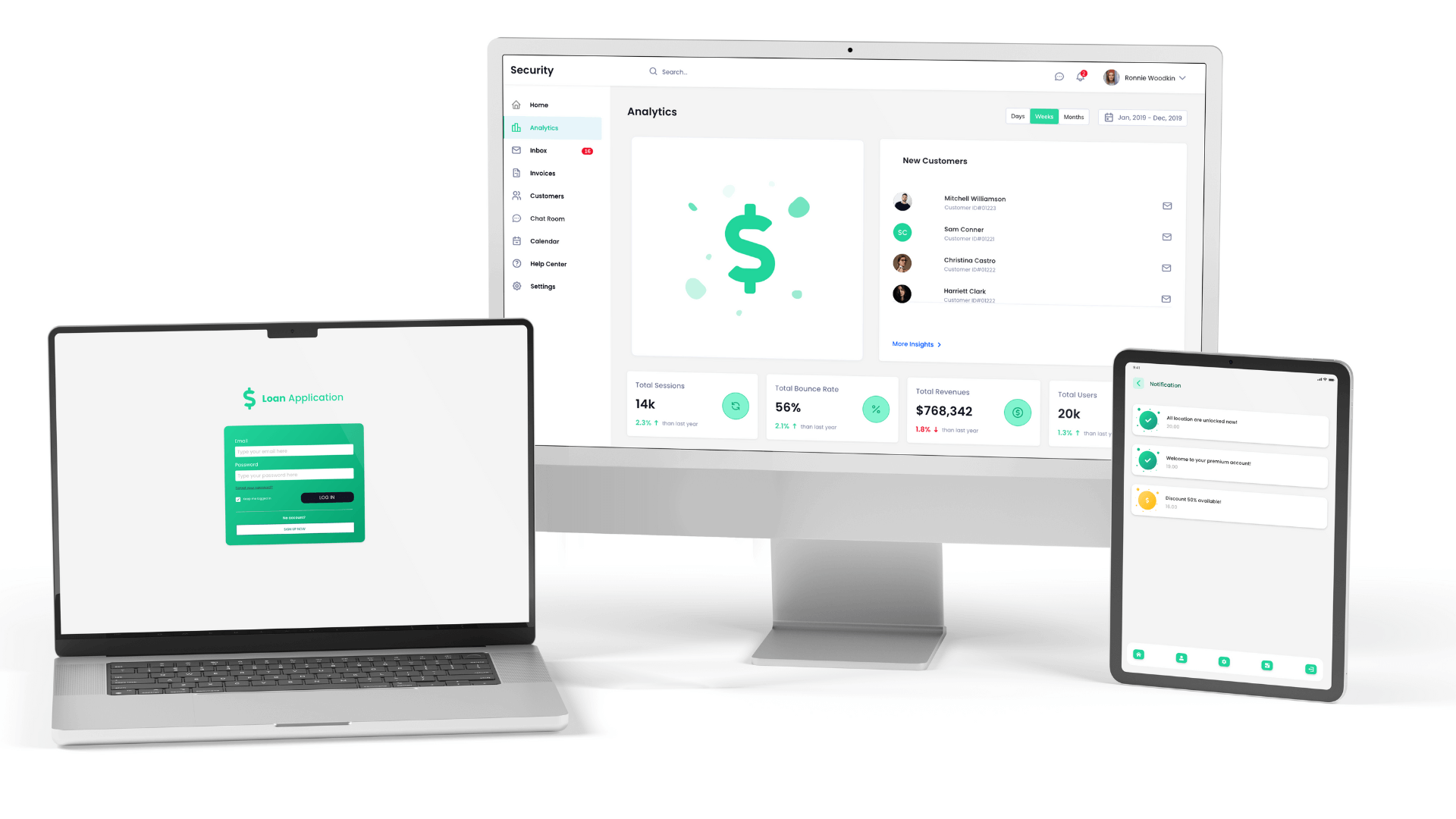

Paper-Free Banking Loan Application

Highlights

- Cross-platform banking software application facilitating and automating the complete lending process.

- Evaluating customers based on risk criteria, reducing the time spent applying for a loan and wasting no paper in the process.

- Compliant with EU regulations and fully integrated into the client’s banking systems.

16

Team Size2+ Years

DurationFinancial

Industry

Client Benefits

Skills

Financial software development skills coupled with a deep understanding of the business context.

Experience

Proven partnership model, and the ability to easily complement their teams with different roles.

Agile

Providing extensive agile expertise and technical consultancy.